Management pension schemes

Attractive pension solutions for key personnel

A modern management pension scheme offers you and your senior staff the opportunity to pay in additional amounts to your pension funds. This makes it possible to boost your own pension and save on taxes, while members can decide for themselves how the money they pay in is invested. The individual retirement assets are also protected from being redistributed in favour of other members.

An attractive management pension scheme also makes sense for employers: companies can lower their occupational pension costs and eliminate the risk of any shortfalls in cover. It also helps them retain highly qualified employees over the long term.

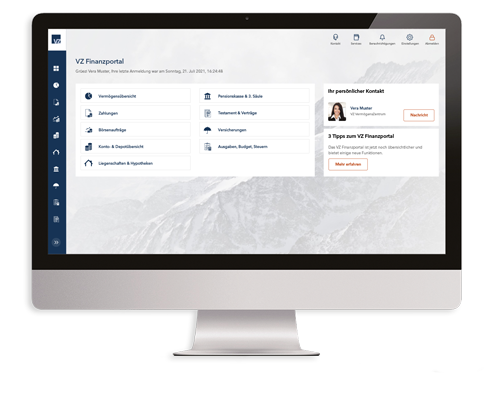

When companies opt for VZ, they get a modern, cost-effective management pension scheme.

Cyrill Bazzana

Position Pension funds Specialist

In "KMU-Special", you can find out how to optimise your pension fund, insurance policies and succession planning:

Important questions about management pension schemes

- What is the advantage of a management pension scheme? This link will open a dialog window.

- What should you take into account with management pension schemes? This link will open a dialog window.

- How flexible can a management pension scheme be? This link will open a dialog window.

- Does a management pension scheme result in higher costs for companies? This link will open a dialog window.

- What are "1e solutions"? This link will open a dialog window.