Services for institutional investors

Save on costs and boost returns

Institutional investors are currently facing real challenges. Managing a portfolio is extremely difficult in today's market environment. Pension funds are also faced with a rising life expectancy and increasing levels of regulation. And the upcoming retirement of the baby-boomer generation is further increasing the pressure.

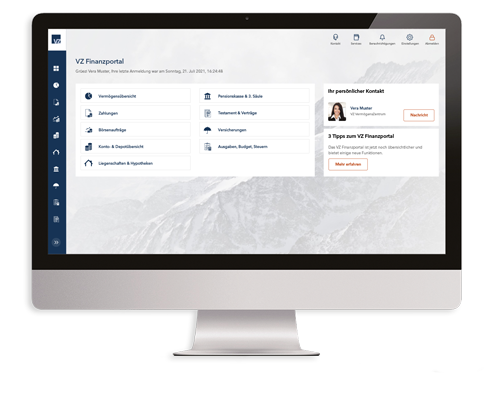

At VZ, we have a wealth of experience and expertise when it comes to finding the right investment strategy. We support a large number of pension funds, charitable foundations, municipalities, associations, churches and companies in implementing their strategy – whether in the role of portfolio manager or simply to provide a second opinion. Pension funds can also delegate their business management activities to us so as to cut down on their administrative work and associated costs.

We provide comprehensive support for pension funds, charitable foundations, municipalities, associations, churches and companies

Independent securities portfolio check

Many pension funds and other institutional investors are paying too much for their financial investments. Portfolio management fees are often unnecessarily high. Many securities portfolios contain banks’ own funds, which are expensive and only perform averagely. They also make frequent use of opaque products with poor performance.

A securities portfolio check at VZ will help identify any weaknesses in your financial investments. Thanks to this independent second opinion, you can take the measures needed to boost your returns.

Portfolio management for pension funds

Foundation boards at pension funds nowadays face many challenges. VZ will help you cleverly and cost-effectively invest your retirement assets – which will greatly benefit your members.

Get regular updates on how to optimise your OASI, occupational and pillar 3 pensions.

Portfolio management for charitable foundations, municipalities, associations, churches and companies

Low interest rates present many institutional investors with a dilemma. On the one hand, they must ensure they have access to the required liquidity. On the other hand, account balances generate no income after adjusting for inflation. At VZ, we manage portfolios for many institutions and help them invest their assets wisely and cost-effectively .

Get regular updates on how to optimise your OASI, occupational and pillar 3 pensions.

Business management mandate for pension funds

It is becoming ever more difficult for SMEs to manage their pension funds themselves. In recent years, there has been a sharp increase in regulatory requirements, which has resulted in more administrative work. Many company pension funds are therefore struggling to cope.

Get regular updates on how to optimise your OASI, occupational and pillar 3 pensions.