Mortgages and real estate

Banks and mortgage brokers usually recommend the mortgages that earn them the most money. By contrast, at VZ we always recommend our customers the mortgage that will cost them the least over the long term. We will provide detailed answers to any questions you might have about real estate – whether about buying a property, for example, or tax- and inheritance-law-related issues. Even if you only want to know how much a property is worth or you would like to sell it, you’ve come to the right place at VZ. We professionally value properties and find the right buyer on your behalf.

Pay less interest on your mortgage by choosing the right strategy

Real estate financing

You can finance your real estate more cheaply with the right mortgage strategy. At VZ, we recommend taking a systematic approach. We’ll draw up your mortgage strategy together with you. This will be reviewed on an ongoing basis. If necessary, it can be adjusted at any time.

- Why is it worth your while to get mortgage advice from VZ? This link will open a dialog window.

- Why does financing cost less at VZ than elsewhere? This link will open a dialog window.

- Who is real estate financing suitable for? This link will open a dialog window.

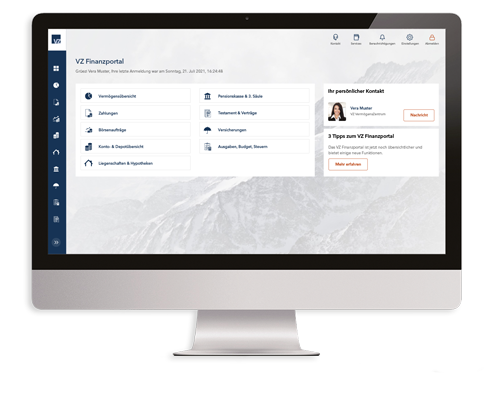

- How can I maintain an overview of my mortgage? This link will open a dialog window.

Discover all the latest news about mortgages as well as interest rate and market trends – with tips on your mortgage strategy:

Mortgage monitoring system

It is a good idea for property owners to cheaply take out money market mortgages for as long as possible and to only switch to fixed-rate mortgages if interest rates rise over the long term. With our mortgage monitoring system, we have developed an intelligent interest rate hedging tool: the VZ mortgage alarm notifies you in good time if interest rates for fixed-term mortgages rise above or below a threshold that you have specified. This provides effective protection against your interest costs rising significantly even if you have a money market mortgage.

- How does the classic interest rate alarm work? This link will open a dialog window.

- How can I use the alarm service as an intelligent interest rate hedging tool? This link will open a dialog window.

- Who is the mortgage monitoring system suitable for? This link will open a dialog window.

- What are the advantages of the mortgage monitoring system? This link will open a dialog window.

Discover all the latest news about mortgages as well as interest rate and market trends – with tips on your mortgage strategy:

Real estate pension scheme

An increasing number of retirees own homes which are largely paid off. However, their income is often too low and they do not have enough liquid assets to cover their living costs. With a real estate pension scheme, you can boost your income without having to sell your home. VZ is the largest provider of real estate pension schemes in Switzerland. Our mortgage experts will help you find and implement a solution, whatever your situation.

- How does a real estate pension scheme work? This link will open a dialog window.

- What are the requirements for a real estate pension? This link will open a dialog window.

- Who is a real estate pension scheme suitable for? This link will open a dialog window.

- Do I have to sell my home when the real estate pension expires? This link will open a dialog window.

- Why is now a good time to take out a real estate pension mortgage? This link will open a dialog window.

- Can a property potential analysis help you boost your reverse mortgage? This link will open a dialog window.

Discover all the latest news about mortgages as well as interest rate and market trends – with tips on your mortgage strategy:

Real estate valuation

Anyone wanting to buy or sell a property should know its current market value. Other reasons for wanting to value a property can include a divorce, inheritance or planned investment. Each year, VZ’s valuation experts value several hundred properties on behalf of their customers. They professionally calculate the market value using the latest valuation methods in line with the quality standards and professional ethics set out by the Swiss Institute of Real Estate Appraisal (SIREA). Depending on the property and the purpose of the valuation, they can recommend either a hedonic valuation or a traditional valuation involving a viewing.

Discover all the latest news about mortgages as well as interest rate and market trends – with tips on your mortgage strategy:

Sale mandate

Properties often account for a significant proportion of people’s total assets. This is why when selling a property, you must be sure that you are getting the best possible price. We recommend that you consult a professional partner in this regard.

VZ’s property experts determine the market value of your property, put together a realistic sale concept and help you find the right buyer. We also ensure that your sale is conducted in a professional manner and advise you on any questions you may have relating to mortgages and other financial matters.

Unlike many other brokers, which often demand a sales mandate with a minimum duration of six or more months, our contracts are more customer-friendly and can be terminated at any time if you are not satisfied.

Discover all the latest news about mortgages as well as interest rate and market trends – with tips on your mortgage strategy: