Banking solutions

All services and products from a single source

At VZ Depository Bank, you can carry out all your essential banking transactions. You benefit from low-cost cards and can use the free-of-charge payment transactions and the digital services in the VZ Finance Portal. VZ Depository is a real alternative to your house bank: choose the fee model that suits your type of investments and trade in securities at particularly favourable rates. In order to avoid conflicts of interest, VZ Depository Bank does not issue its own financial products and does not earn money from brokering.

Accounts: the right account for your banking transactions

VZ Depository Bank has the right account for your banking transactions. Whether you wish to make payment transfers, invest assets or grow your savings, you get everything from a single source and more cost-effectively than at other providers. There's also a deposit guarantee for amounts of up to CHF 100,000 per client. If you don't yet have a savings or private account with VZ, open your account here. Or contact our free transfer service. We'll be happy to help you change banks.

- Interest rates at VZ This link will open a dialog window.

- Selecting the right account This link will open a dialog window.

- Protecting your deposits This link will open a dialog window.

- Conveniently order cash This link will open a dialog window.

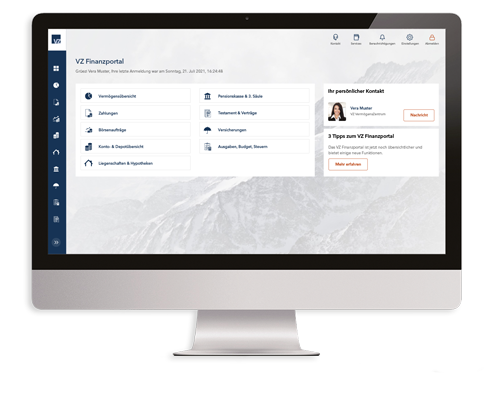

- VZ Finance Portal: secure and transparent via e-banking This link will open a dialog window.

Find out every week about the latest developments in the financial markets:

Payment transactions: process all your payments quickly and at a low cost

The private account at VZ does not charge any fees and you can process all payments free of charge. You can withdraw amounts of up to 100,000 francs without giving notice within 31 days; for higher amounts, two months’ notice must be given. And thanks to eBill, you can receive and pay all your bills paperless.

- Fees for payment transactions This link will open a dialog window.

- eBill: easy online payments This link will open a dialog window.

- Direct debits and standing orders This link will open a dialog window.

- Written payment orders This link will open a dialog window.

- TWINT: digital payments via mobile phone This link will open a dialog window.

- QR invoices: simply scan and release the invoice This link will open a dialog window.

- VZ Finance Portal: all your account information at a glance This link will open a dialog window.

Find out every week about the latest developments in the financial markets:

Cards: the right card for your payments

As a customer of VZ Depository Bank, you can carry out card transactions at a low cost. You can order the VZ Debit Mastercard directly here.

Find out every week about the latest developments in the financial markets:

Securities Custody Account: invest money safely and cost-effectively

Anyone wishing to trade on the stock exchange at fair conditions should maintain their securities account at VZ. Open a custody account now.

Customers can easily buy and sell securities, securely and at attractive conditions, as the transaction and securities account fees at VZ Depository Bank are significantly lower than at other providers. And even if you want to manage your securities account yourself, all retrocessions will be reimbursed to you.

Find out every week about the latest developments in the financial markets: