Trading securities at low cost

The right fee model for investors

Excessive fees erode the net return. Many investors do not take this fact seriously enough. With VZ, investors choose between two fee models. In either case, the potential for savings is enormous.

"Ticket fee" Securities Custody Account

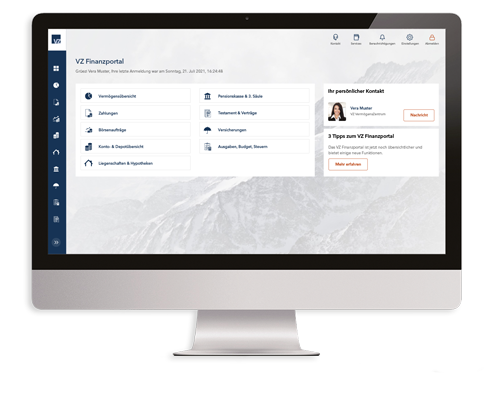

The "Ticket Fee" model gives you free access to the VZ Financial Portal Pro trading platform. At the same time, you benefit from the maximum discount level of 50% on your online transaction fees.

Securities account and account management

Transactions

Volume discount for transaction fees

The applicable discount level for the following month is calculated on the last bank working day of the month at 12 noon (CET/CEST). This takes into account all transactions (sale and purchase orders) that have been booked in the relevant portfolio by this day over the last three months (see table below). The discount level calculated for the following month is applied on the "Financial Portal tariff".

You will automatically receive discount level 3 for the first three months. On the last bank working day of the third month, the discount level will be recalculated on the basis of the transactions carried out.

Flat-fee Securities Custody Account

Fees are charged quarterly and debited directly from the customer’s bank account. The fee rates are gross amounts, prior to the reimbursement of any repayments of stock commissions and retrocessions.

The fees include the following banking services:

- Bank fees for transactions in direct investments, incl. ETFs via the VZ Financial Portal

- Securities account fees

- Account management

- Dispatch and postage costs

- Real-time data for Switzerland, Europe and the US

- VZ Financial Portal Pro

If transactions are placed by phone or if the transaction takes place outside of the stock exchanges available in the VZ Financial Portal, a fee of CHF 60 per order is charged.

Overview of the VZ fee models

"Ticket fee" for occasional traders: You pay a minimum custody account fee and very favourable transaction costs. Available stock exchanges

Flat-fee for frequent traders: You pay a flat deposit fee, and all transactions are included. As a result, you know exactly what your fees will be. Available stock exchanges

Would you like to benefit from the favourable fees? Please contact [at] vzdepotbank.ch (subject: Subject%3A%20VZ%20fee%20model, body: Dear%20Sir%20or%20Madam%20%0A%0AI%20am%20interested%20in%20the%20VZ%20fee%20model.%20Please%20get%20in%20touch%20with%20me.%20%0A%0AName%3A%20%0AFirst%20Name%3A%20%0AYear%20of%20birth%3A%20%0AStreet%2FNo.%2C%20Postcode%2FCity%3A%20%20%0APhone%20number%3A%20%0ABest%20time%20to%20call%3A%20%0A%0ABest%20regards%0A) (email) or call us.

The VZ fee models compared to those of competitors

Depending on which type of investor you are, VZ offers two different fee models. No matter which you opt for, you can trade securities at VZ for an extremely competitive price.

Lower fees thanks to retrocessions

According to the decision of the Federal Supreme Court, financial institutions must pass on commissions – provided they have been paid in connection with investment products and within the scope of an asset management mandate. VZ has always passed on the so-called retrocessions to our clients.

- VZ Depository Bank is one of the few banks that passes on retrocessions to its clients even if they manage their custody accounts themselves.

- VZ Depository Bank credits the retrocessions on a quarterly basis and reports them transparently for each individual security. The credit may even exceed the custody account fee.

- Therefore, clients may actually receive money for keeping a custody account with VZ Depository Bank.