The Foundations of VZ

VZ Vorsorge AG provides advisory, administrative and management services for investment foundations, pension institutions and occupational pension provision institutions. In addition, VZ Vorsorge AG acts as a tied agent within the meaning of the Insurance Supervision Act (ISA) when advising companies.

Get regular updates on how to optimise your OASI, occupational and pillar 3 pensions.

VZ Investment Foundations: attractive investment solutions for institutional investors

VZ Investment Foundation and VZ Investment Foundation 2 offer carefully designed, cost-effective and sustainable investment solutions for tax-exempt pillar 2 institutions. The focus is on broadly diversified index strategies, which can also take account of ESG criteria if so desired. Investments are made in line with the best-in-class approach. Our investment experts only select the financial products that promise investors the greatest benefit, regardless of the provider.

The asset allocation types VZ Residential Mortgages 1 and VZ Residential Mortgages 2 are also available to external investors. Institutional investors can gear their investments to their specific needs by combining different mortgage terms.

Advantages for institutional investors

- Independence: VZ does not sell financial products of its own.

- Flexibility: The wide range of investments covers investors’ different needs, so assets can be invested in a flexible, customised manner.

- Low costs: VZ Investment Foundation uses low-cost institutional funds. As pension assets are pooled, investors benefit from an attractive fee structure.

- Attractive investments: The investments are broadly diversified, transparent and tax-optimised.

- Security: The investments comply with the legal investment provisions set out in the Occupational Pensions Ordinance (OPO 2).

- Transparency: All investment groups are valued weekly. Allocation, performance and all key risk indicators are reported transparently.

Download the VZ Investment Foundation factsheet

Download the VZ Investment Foundation 2 factsheet

VZ OPA Collective Foundation: High-performance pension solution for SMEs

The VZ OPA Collective Foundation is an individually tailored pension solution for SMEs. Thanks to low risk premiums and low management costs, insured companies can save several thousand Swiss francs every year.

Your advantages

- Cost savings: The VZ OPA Collective Foundation bundles many small companies by means of pooling, which means that the insured companies can save up to 30 percent of their prior risk premiums and management costs.

- Flexibility: Affiliated companies can match their investment strategy to their own needs and their individual risk appetite.

- Fairness: If a company terminates its affiliation contract, the actual balance is paid out at the time of termination.

For administrative and financial reasons, it is advisable to obtain insurance for accident, daily sickness and pension benefits from a single source. As a company insured with VZ OPA Collective Foundation, SMEs can save up to 30 percent of their prior risk premiums and management costs.

VZ Collective Foundation: Invest individually and save taxes

VZ Collective Foundation insures salaries in excess of CHF 136,080 and offers insured persons individual investment options and potential tax savings.

Your advantages

- Cost savings: VZ Collective Foundation offers low management costs and low risk premiums thanks to a solid risk structure.

- Flexibility: VZ Collective Foundation is flexible thanks to the individual planning on company level and because of the different investment options existing at the insured level. In terms of savings, up to three savings plans are possible, and the retirement assets may be received as a lump sum, annuity or in hybrid form.

- Tax savings: By increasing their savings contributions, senior executives can increase their purchasing potential and thus reduce their taxable income.

- Capital protection: In the event of the insured person’s death, VZ Collective Foundation pays not only the pension benefits but also the entire savings capital, including voluntary purchases, to the survivors.

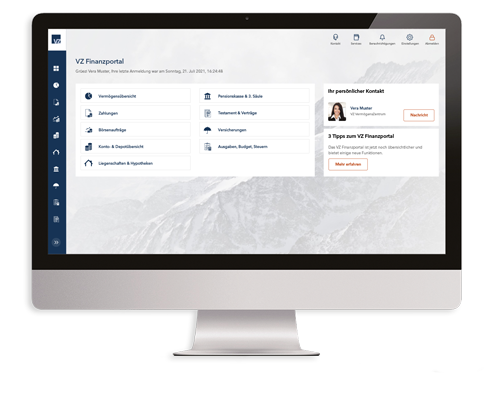

- Transparency: The VZ Financial Portal allows registered investors to review their custody account at any time and adjust their investment strategy. VZ prepares clear reporting on a regular basis.

- Independence: VZ Collective Foundation does not have any investment products of its own. Regardless of the provider, the products that will bring the greatest benefit to the client are selected.

VZ Vested Benefits Foundation: Invest pension assets cost-effectively

The VZ Vested Benefits Foundation invests pension assets individually and cost-effectively. Investors can review and adjust their investment strategy in the VZ Financial Portal at any time and free of charge.

Your advantages

- Cost savings: Investments are made in low-cost index products, and the asset management fees depend on the investment strategy selected.

- Flexibility: VZ Vested Benefits Foundation offers investors various investment options. The investment strategy can be changed on a weekly basis.

- Overview: Thanks to online access, investors can always keep an eye on their custody account and adapt their investment strategy at any time. VZ prepares transparent reports on a regular basis.

- Independence: VZ Vested Benefits Foundation does not have any investment products of its own. Regardless of the provider, the products that will bring the greatest benefit to the client are selected.

VZ Pension Foundation 3a: Invest flexibly in the best ETFs

Investors with a pillar 3a at VZ invest in the best ETFs and can achieve a large additional return over the years. Clients of VZ Pension Foundation 3a decide on their own when to sell the securities.

Your advantages

- Cost savings: Thanks to low-cost ETF investments, the pillar 3a is up to 60 percent cheaper at VZ than at other providers.

- Tax benefits: The tax savings for gainfully employed persons with a pension fund amount to up to CHF 3,000 if the maximum amount is paid in.

- Flexibility: Investors select their investment strategy themselves. All ETFs can be transferred to the private securities custody account upon retirement.

- Overview: Online access gives investors an overview of their investments, their performance and other key data at any time.

- Independence: VZ Pension Foundation 3a does not have any investment products of its own. Regardless of the provider, the products that will bring the greatest benefit to the client are selected.