Asset management mandates

Investing money with VZ

With an asset management mandate, you benefit from a systematic approach towards investing money, which will lead to higher returns over the long term. At VZ, we combine an investment approach that avoids taking risks, an independent implementation of this approach and active support. Investments are mostly made in index investments, such as ETFs, and depending on the mandate, in individual stocks or actively managed funds. ETFs are especially attractive because investors' money is broadly diversified and significantly fewer costs are incurred. Investors wishing to invest in line with ESG criteria are also in the right place with VZ.

Investment strategy without experiments + independent implementation + active support = long-term investment success

Asset management with index investments

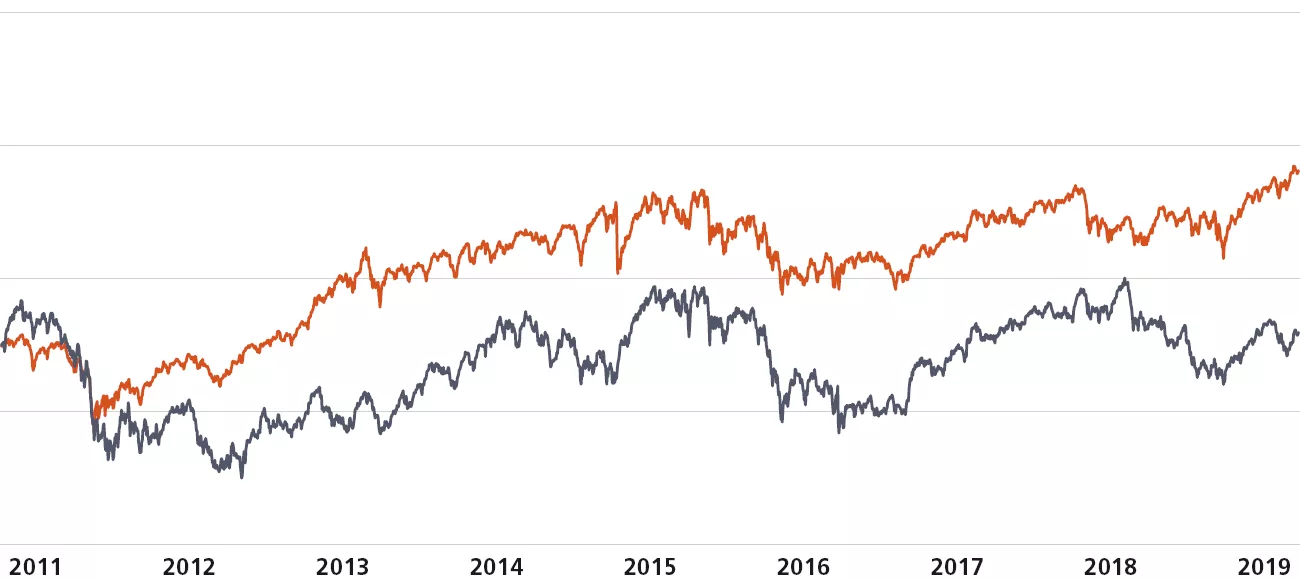

Only few actively managed investment funds are able to outperform the market. Any by using cost-effective ETFs and other index funds, it is possible to easily cover a broadly diversified range of asset classes in a transparent manner, without the risk of "active betting" or high fees negatively impacting the result.

With the asset management mandate with index investments, we seek out the best index funds for you and monitor them regularly. Thanks to our independence, we always make our decisions without any conflicts of interest. And as we consistently pass on any discount, we can keep your costs to an absolute minimum. These lower costs contribute to higher returns over the long term.

Most years, the equity index (orange) outperforms active equity funds (grey)

- How does the asset management mandate work? This link will open a dialog window.

- Who is the mandate suitable for? This link will open a dialog window.

- Which investment instruments do we use? This link will open a dialog window.

- Why opt for index funds? This link will open a dialog window.

- What are the advantages of independent asset management? This link will open a dialog window.

Find out every week about the latest developments in the financial markets:

Asset Management with Index Focus ESG

Index funds are very cost-efficient, market-oriented investment instruments. Consequently, they are particularly suitable for asset accumulation. Asset management with index investments focusing on ESG takes account of social, environmental and governance criteria, as well as financial indicators, in its valuation and selection of funds. This results in a good risk/return profile and aligns the portfolio appropriately in the long term. The index funds used are monitored on an ongoing basis. If other funds meet the qualitative and quantitative criteria even better, it is checked whether swapping funds would make sense.

VZ monitors all index funds available on the market and picks the best for each asset class in a selection process that takes ESG criteria into account

- How does the asset management mandate work? This link will open a dialog window.

- Who is the mandate suitable for? This link will open a dialog window.

- Which investment instruments do we use? This link will open a dialog window.

- Why opt for index funds? This link will open a dialog window.

- What are the advantages of independent asset management? This link will open a dialog window.

Find out every week about the latest developments in the financial markets:

Asset Management with Investment Funds Focus ESG

In addition to return and risk considerations, ESG criteria are also explicitly taken into account in investment decisions of the Asset Management with Investment Funds Focus ESG mandate. The qualitatively and quantitatively best funds are selected in a multi-stage process. Preference is given to cost-efficient index funds with improved ESG characteristics. Active funds can also be used in a targeted manner to lend even more weight to ESG criteria.

The mandate invests in equities and bonds of companies that show good environmental and social characteristics, as well as corporate social responsibility

- How does the asset management mandate work? This link will open a dialog window.

- Who is the mandate suitable for? This link will open a dialog window.

- Which investment instruments are used? This link will open a dialog window.

- What does investing with an ESG focus mean? This link will open a dialog window.

- What are the advantages of independent asset management? This link will open a dialog window.

OPA-focused asset management

To successfully manage their members' money, many Swiss pension funds base their strategy around the Pictet LPP Indices. You can also implement this investment strategy as a private investor. Thanks to its intelligent rebalancing mechanism and use of ETFs and other index funds, the OPA-focused asset management mandate is a cost-optimised and long-term structured investment solution with significant return potential.

With this mandate, individuals are able to invest their money in the same way as a Swiss pension fund

Find out every week about the latest developments in the financial markets:

Asset management with individual securities

Our professional selection process and multi-strategy approach make our asset management mandate with individual securities a unique total investment solution. With this asset management mandate, you can invest in individual securities and benefit from dividend income as well as from the price potential of companies.

The selection process and strategy approach offer opportunities for attractive returns

Asset management top Swiss dividend equities

With the asset management mandate top Swiss dividend equities, you invest in an equities asset and benefit from regular dividend distributions in all market phases. Promising equities are selected according to objective criteria and their performance is continually monitored.

Promising equities are selected based on stability and potential indicators and are continually monitored