Companies

Wide-ranging corporate advisory services

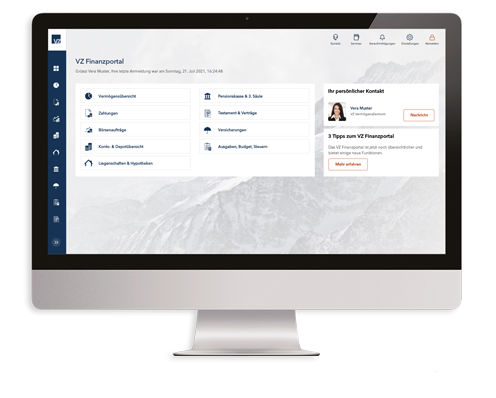

VZ offers companies and institutional clients a wide range of services. We advise them on all business, insurance and investment issues and offer attractive occupational pension solutions for their employees. And if you want to found a company or put succession plans in place, we will also provide comprehensive support.

More benefits for less money. That’s the aim of VZ’s sustainable consultation process.

Simon Tellenbach

Director for Corporate Clients

Free-of-charge first consultation

In "KMU-Special", you can find out how to optimise your pension fund, insurance policies and succession planning: