Investments

All you need to know about ETFs

ETFs are cheap, transparent and liquid. However, the high demand for ETFs means that providers are constantly developing new product variations, some of which no longer bear much relation to the original idea of an ETF. There can also be significant differences in returns on different ETFs based on the same index. This makes it all the more important today to take a close look at the securities available for selection when choosing ETFs.

Jan Simon

Position Investment Expert

Recommend post

16 May 2025

Definition and characteristics of ETFs

The abbreviation ETF stands for exchange traded fund. If you purchase an ETF, you're buying a share in a stock market index, such as the SMI, Dow Jones or DAX. ETFs attempt to replicate an index as closely as possible – either physically or synthetically.

ETFs are securities that are traded like shares on a stock exchange and can therefore be bought or sold at any time during trading hours. Like the index, their price changes constantly during a trading day. If the index rises, the value of the ETF also increases. If the index falls, the ETF loses value.

ETFs have several characteristics that are comparable to those of traditional investment funds. Like investment funds, they invest in a basket of securities such as shares. Investors participate in this basket of securities via their ETF holdings. ETFs thus give them broad diversification cheaply and easily.

However, there's a big difference between investment funds and ETFs. In contrast to ETFs, traditional investment funds attempt to achieve a higher return than their benchmark by buying and selling securities. This requires fund management companies, which continuously analyse the securities in the fund and reallocate securities where necessary.

Dozens of studies worldwide have proven that many actively managed funds don't manage to outperform their benchmark after the deduction of costs. Moreover, a VZ study shows that many Swiss equity funds are not as actively managed as they claim to be and therefore generate high costs unnecessarily.

By contrast, ETFs merely aim to replicate the underlying index one to one. As a result, they don't require expensive management. This leads to significantly lower fees than with conventional investment funds. ETFs are often also referred to as passive funds or passively managed funds.

Investors should be aware that ETF investments fully participate in the fluctuation in value of the index. The return on an ETF therefore generally corresponds approximately to the index return minus the fees for the ETF. This means that it's crucial to choose the right index.

Each equity ETF receives dividend payouts from the equities in the ETF and passes them on to its investors. Distributing ETFs pay the dividend into investors' accounts, whereas accumulating ETFs reinvest them automatically.

Trends in ETFs

The first ETFs were offered in Switzerland in the year 2000. Since then, the number of ETFs has shot up year after year. Today, over 1,500 products are listed on SIX Swiss Exchange. While ETFs initially only covered equity indices, other asset classes, such as interest rates, commodities and real estate, have been added over time. ETFs now also exist for specialised topics such as sustainable investments. Currency-hedged ETFs are available too, which offer protection against currency risks.

Another recent development has arisen in the area of index construction: factor ETFs. This kind of ETF also tracks an index. However, the index used is not a traditional one with weightings based on market capitalisation, but rather one with alternative weightings (e.g. equal-weighted indices) or with exposure to certain return factors (e.g. value or dividends).

The success of ETFs has led to products coming onto the market that are more complex and often less transparent and much more expensive. They no longer bear any significant relation to the original idea of replicating an index on a one-to-one basis. For example, investors can use short ETFs to bet on falling markets or leverage ETFs to track a multiple of the daily return of an index.

For some years now, there have also been active ETFs that attempt to outperform the benchmark index. As with active investment funds, active ETFs run the risk of significantly underperforming the index. What's more, they're often more expensive than traditional ETFs.

The wide range and increasing complexity make it difficult for investors to choose the right ETF. It's advisable to invest only in products whose mechanisms you understand. Given the increasing availability of index funds, you should also check whether an ETF or an index fund is the better choice in your specific case.

Find out every week about the latest developments in the financial markets:

Advantages of ETFs

ETFs are cheap, liquid and transparent, which means they're particularly suitable for long-term wealth accumulation by private investors.

Low Costs

When you buy and sell an ETF on the stock exchange, you'll be charged standard bank fees in the same way as for shares. There is also a trading spread between the buying price and selling price. However, ETFs have no issue or redemption fees. Such fees can amount to up to 5 percent of the investment amount in the case of traditional investment funds.

Actively managed funds generally deduct recurring annual management fees of 1 to 2 percent. The average management fee for bond ETFs available on the SIX Swiss Exchange is 0.24 percent. ETFs on the theme of "developed region equities" have an average management fee of 0.25 percent (see table below).

Some products even have a total expense ratio (TER) of less than 0.10 percent. Others are slightly more expensive: the average management fee for ETFs on emerging market equities is 0.47 percent and for ETFs on commodities 0.39 percent.

Low costs are an important criterion for long-term investment success. For example, if you invest CHF 200,000 in actively managed funds that earn an annual return of 4 percent and deduct 1.5 percent for management, you can sell these funds for CHF 256,000 after 10 years. If you invest the same amount in an ETF with fees of only 0.3 percent, you'll achieve an additional return of around CHF 31,000 over 10 years. Over 20 years, the additional amount will grow to practically CHF 86,000.

Very flexible and liquid

ETFs are liquid investment instruments, like shares. They can be bought and sold during exchange trading hours. Market makers guarantee binding bid and ask prices. Every ETF provider needs at least one market maker. Many ETF issuers even work with several market makers to ensure that their ETFs are even more liquid.

Very transparent

ETFs are transparent. Many ETF providers publish the composition of their portfolios on their websites every day. Traditional funds often only do this every six months because they want to keep the composition of their portfolios secret.

Very secure

Like traditional investment funds, ETFs are also subject to the Federal Act on Collective Investment Schemes (CISA). The CISA stipulates that investors are protected if an issuer of such collective assets becomes insolvent. ETF investors are therefore generally not exposed to counterparty risk. Synthetically replicated ETFs are an exception. They incur counterparty risk to a limited extent.

Well diversified at low Costs

ETFs allow investors to diversify appropriately even with small investment amounts. For example, you don't have to buy all 20 securities in the Swiss share market index SMI individually. Instead, you can use an ETF on the SMI to acquire shares in all SMI securities in one single transaction. This leads to significantly lower transaction costs.

ETFs are also a suitable measure to accumulate assets with regular investments. An ETF savings plan or a pillar 3a account at VZ allows you to buy the best ETFs that are traded on SIX Swiss Exchange. VZ analyses and values all securities independently without any vested interests.

Differences in ETF Returns

ETF returns can vary considerably – even if they track the same index.

We compared four ETFs on the MSCI World Total Return Index listed on SIX Swiss Exchange. In 2020, the return on the best ETF was 0.56 percentage points higher than that of the worst. In 2021, the difference was even 0.69 percentage points (see table).

The difference in returns can mainly be explained by the different levels of fees charged by these four ETFs. Other reasons for the difference may be the type of replication of the ETF and the fund domicile, which has a tax impact.

ETFs and taxes

Dividend and interest income is subject to income tax in Switzerland, while invested assets are subject to wealth tax. This also applies to ETFs – regardless of whether the income is distributed or reinvested (accumulated). However, accumulating ETFs, which comprise the majority of ETFs listed in Switzerland, are required to report income separately. The taxable income from ETFs can be found in the Federal Tax Administration's price list ("Course listings").

Withholding taxes are also important for ETF investors. Income from ETFs on Swiss equities, for example, is subject to withholding tax of 35 percent. These ETFs therefore only pay out 65 percent of gross income from dividends to investors. Unlike foreign ETFs, ETFs domiciled in Switzerland may reclaim this withholding tax.

So if you're investing in Swiss assets, you should choose an ETF domiciled in Switzerland. This means that the return on foreign ETFs is around 1 percentage point per year less than that of Swiss ETFs, assuming a dividend payout of 3 percent on Swiss equities.

Many other countries also have a withholding tax on interest and dividends that is comparable to the Swiss withholding tax. It makes sense to favour certain fund domiciles and avoid others, depending on whether there's a tax agreement with that country or not. For example, investing in US equities via an ETF domiciled in Ireland is particularly attractive due to the dual taxation agreements in place.

The Swiss government levies stamp duty on the purchase or sale of an ETF, as with shares and bonds. This is particularly significant for investors who trade a lot. Stamp duty is 0.075 percent for funds domiciled in Switzerland and 0.15 percent for funds domiciled outside Switzerland.

How ETFs differ from index funds

More and more index funds are becoming available for private investors who wish to invest passively, in addition to ETFs. In recent years, fund providers have opened up numerous index funds to private investors that were previously reserved for institutional investors.

Both ETFs and index funds aim to replicate an index as accurately as possible. Moreover, there is hardly any difference between ETFs and index funds in terms of management fees. They are much lower for both product types than for active funds.

The main difference between ETFs and index funds lies in their stock exchange listing. ETFs are exchange-traded funds and can therefore be bought and sold at any time during trading hours. By contrast, index funds are not traded on an exchange. As with active investment funds, buying and selling is only possible once a day via the fund provider.

So if you want constant tradability, you're better off with an ETF. But if trading once a day is enough for you, you can also invest in an index fund. The range of ETFs on offer is much larger, but index funds are subject to a lower stamp duty than ETFs, depending on their domicile. And while ETFs can be replicated physically and synthetically, many index funds only allow physical replication of the index. The replication type indicates how a passive fund replicates the corresponding index.

Six steps to the right ETF

Investors should take a systematic approach to find the right ETFs.

Step 1: Define your investment strategy

The most important factor for long-term investment success is an appropriate investment strategy, i.e. allocating investments to the various asset classes, such as equities and bonds, in line with your specific risk capacity and risk appetite.

Nowadays, you can implement an investment strategy with ETFs alone. SIX Swiss Exchange offers a choice of over 1,500 ETFs, which invest in a wide range of asset classes, markets and currencies, allowing investors to broadly diversify their assets.

Implementing an investment strategy exclusively with ETFs has various advantages: ETFs are cheap and can be traded daily, and the risk of a significant underperformance compared with the benchmark is virtually eliminated.

Step 2: Select an index

Investors should be aware that ETF investments fully participate in the fluctuation in value of the index. This means that it's crucial to choose the right index.

To get an idea of an ETF's performance, you should look at the historical returns and price fluctuations of the underlying index. A relatively long time period should be considered, if possible.

It is also helpful to understand the calculation and composition of the index. Many indices weight securities according to their market capitalisation. Investors that opt for ETFs on such indices are incurring a cluster risk that they shouldn't underestimate. In the SMI and SPI, for example, the three heavyweights Nestlé, Novartis and Roche make up around 50 percent of the index.

Step 3: Check replication quality

Many investors assume that an ETF replicates its benchmark index one to one. This would mean that the ETF return would correspond to the benchmark return. But that is not the case. There can be differences in returns of several percentage points per year between individual ETFs on a given index.

To gauge the replication quality of an ETF, it's worth comparing its return with that of the index. If there's a large difference, it's best to exercise caution. In the case of equity ETFs, you should also check that both the ETF and its index reinvest the dividends or that both refrain from reinvesting the dividends.

Step 4: Select replication type

"Replication type" refers to the way in which an ETF replicates an index. A basic distinction is made between physical replication and synthetic replication. In the case of physical replication, the ETF invests in the securities contained in the index, taking into account their respective index weighting.

Synthetic replication works via financial derivatives. It's more complicated and less transparent than physical index replication. Yet certain markets can be replicated much more efficiently using synthetic replication, especially if the index components are only tradable to a limited extent.

The risks arising from physically replicating ETFs are often considered to be lower. Under certain circumstances, however, synthetic replication can make perfect sense. The appropriate type of replication must therefore be assessed on a case-by-case basis.

All ETFs traded on the Swiss stock exchange can be found at www.six-swiss-exchange.com and filtered according to various criteria, such as the replication method.

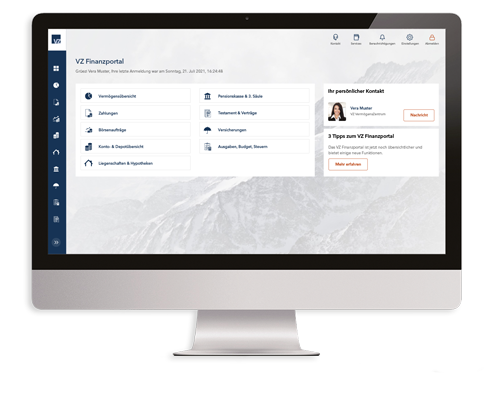

Step 5: Compare annual costs

You can get an idea of the annual costs payable for an ETF by looking at the total expense ratio (TER). In addition to the management fees, it also includes the costs for advertising and distributing the product. Information on the TER or the management fees is available in the ETF's monthly report. You can download monthly reports in PDF format (in German and French) from the VZ Financial Portal for the relevant ETF.

However, the TER doesn't include all costs. For example, it doesn't include transaction fees within an ETF, for example. Moreover, a lower TER doesn't necessarily mean a higher return.

Ultimately, it's not possible for investors to gain a definitive overview of the various cost components of ETFs. But that's not absolutely necessary. What matters for investors is the difference between the historical ETF return and the index return. This difference includes all costs.

Step 6: Optimise taxes and trading costs

When selecting an ETF, investors should always consider the fund's domicile. An unfavourably selected fund domicile can have a negative impact on the planned ETF investment from a tax perspective, because withholding taxes may dent the return.

When you buy and sell ETFs, you need to pay standard bank fees, stamp duty and stock exchange fees. These are particularly significant for investors who trade a lot. Additionally, you should have a closer look at ETFs' buying and selling prices. There's usually a difference between the buying price (bid price) and the selling price (ask price). This difference is known as the spread.

In particular investors who only want to hold an ETF for a short time should look for a low bid-ask spread. As a rule of thumb, investors should carry out their transactions in the middle of the trading day, as spreads are often higher at the beginning and end of the day. ETFs are traded on SIX Swiss Exchange from Monday to Friday between 9.15 a.m. and 5.15 p.m.

When buying or selling an ETF, it's also important to check that the securities contained in the ETF are being traded at the time of the transaction. For example, if you want to buy US equity market ETFs on the Swiss stock exchange, you should do so when the US stock exchanges are open. Otherwise, you can expect spreads to be larger.

Would you like to grow your assets cost-effectively with ETFs? VZ will provide you with professional support in choosing the right ETFs. It will also select the best ETFs on SIX Swiss Exchange for you. With VZ as your partner, you can be sure that all securities are analysed and valued on an independent basis.

Saving and investing with ETFs

Asset management with index investments