Insurances

Compulsory insurance in Switzerland

When foreigners move to Switzerland for the first time and work here, they should know what insurance they are required to have by law.

Anybody who works in Switzerland is automatically covered by the government's old-age, survivors' and invalidity insurance (OASI/DI) as well as their employer’s pension fund and accident insurance. Your employer automatically deducts the contributions for these insurance schemes from your salary each month.

By law, you are also required to take out basic health insurance (known as "Grundversicherung"), which you must obtain from a health insurer within three months of registering in Switzerland. You are only exempt from this requirement in exceptional circumstances.

To drive a car or ride a motorcycle in Switzerland, you require vehicle third-party liability insurance, which covers any damage you may cause with your vehicle to third parties or their property, If you rent an apartment or house, your landlord usually requires you to take out private liability insurance, which covers damage caused by tenants, for example. In most Swiss cantons, building owners need to have insurance covering damage caused to the building by fire or natural events such as storms, floods or landslides.

Insurance policies other than those listed are not compulsory, but are highly recommended. In particular, you should ensure you have sufficient cover against potential risks that could have an adverse effect on your budget or even threaten your existence. By contrast, anything you can cover yourself without any problems does not need to be insured.

There are huge differences in price and the benefits offered by the various insurance companies, so it is worth shopping around.

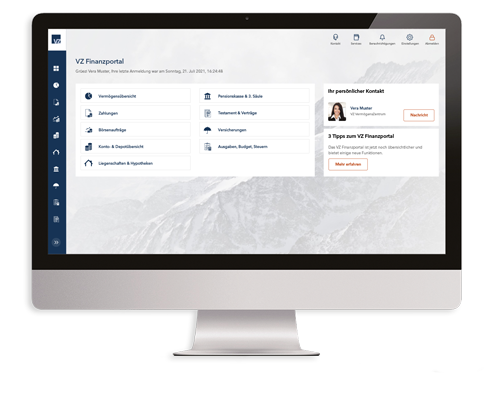

Would you like to be properly insured at a low price? Our independent insurance experts will show you which insurance you really need and where you can get it for the best price. Arrange a non-binding appointment at your local VZ branch now.