Pillar 3a: key questions and answers

What is the maximum amount I can pay into pillar 3a in 2021?

In 2021, employees and self-employed persons with a pension fund may contribute up to CHF 6883.

Self-employed persons without a pension fund may contribute up to 20 percent of their net earned income. However, their contribution is limited to CHF 34,416.

Which investment strategies can I choose from?

You can select one of six investment strategies with an equity component of 15 to 97 percent. Depending on your risk tolerance, we recommend an investment strategy with the appropriate degree of risk. Experienced investors can compile their pillar 3a individually within the legal requirements.

This is what you need to bear in mind when defining your investment strategy

In which asset classes can I invest?

You are free to combine your portfolio from the following seven asset classes within the legal requirements:

- Swiss shares

- Foreign shares

- Swiss bonds

- Foreign bonds

- Real estate

- Specialities and commodities

- Liquidity CHF

VZ invests your assets in the best index funds and Exchange Traded Funds (ETFs) traded on the SIX Swiss Exchange. You can select one or more securities per asset class.

What are ETFs?

Like conventional funds, Exchange Traded Funds (ETFs) invest in different securities and thus spread the investment risks. In contrast to traditional funds, ETFs track their benchmark index one-to-one and do not attempt to outperform it.

ETFs do not require an active fund management, which saves fees. They are usually both cheaper and more successful than conventional funds, whose performance often lags behind their benchmark.

ETFs are traded daily on an exchange.

If the ETF issuer or the custodian bank goes bankrupt, there are hardly any risks for the investors because ETFs do not fall into the bankruptcy estate but instead are treated as so-called special assets that remain in the possession of the investors.

How much are the fees?

The annual fees are 0.68 percent, but at least CHF 10 per quarter. This includes all costs such as transaction fees and custody fees. Investments of new funds and the weekly rebalancing are free of charge.

Not included are the costs for immediate buy and sell orders. They are settled at VZ Depository Bank’s current e-banking rate.

Also not included are the management fees for the individual ETFs and index funds. They average 0.16 percent and are charged directly to the fund assets.

When are cash deposits invested?

As a rule, deposits into your account and transfers from other foundations are invested weekly if more than CHF 500 have been deposited since the last investment or since the account was opened.

Is there a minimum investment amount?

No, there is no minimum amount.

How much does it cost to transfer my existing pillar 3a to VZ?

Most banks do not charge any fees for the transfer of a pillar 3a balance. However, costs may be incurred when selling fund units. Ask your current bank or pension foundation how much they will charge.

Is it possible to open a pillar 3a account without Internet access?

Yes, if you do not have Internet access, you can open your Pillar 3a by phone. It is also possible to request strategy adjustments by telephone.

Will I receive a printed report?

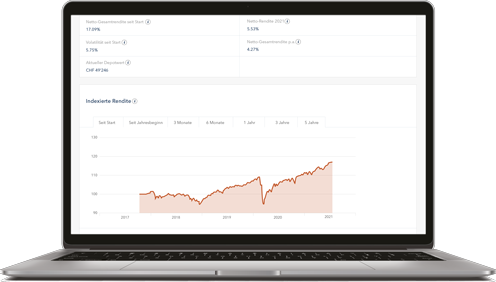

You will receive a tax certificate at the end of the year and a securities account statement at the beginning of each quarter. You can look up the current value of your securities account at any time in the password-protected area of VZ Finanzportal.

What will happen to my credit balance when I retire?

You can pay out the balance to a personal account or a savings account or have the securities transferred to your personal securities custody account.

3a assets may be withdrawn at the earliest five years before reaching the normal AHV retirement age. If you continue to work beyond the normal retirement age, you may continue to pay into the 3rd pillar and postpone the withdrawal of the balance - men up to 70, women up to 69.

For tax reasons, it is usually best to have second and third pillar assets paid out in several years.

Can I withdraw my pillar 3a early?

You may withdraw your pillar 3a early if you purchase residential property, become self-employed, emigrate permanently from Switzerland, receive a disability pension or wish to transfer your 3a assets to your pension fund.