Pension solutions

Be sure your pensions are on solid ground

At VZ, pillar 3a pensions are a flexible securities solution for people with an eye on fees. You benefit from up to 60 percent lower fees, which over the years can result in additional returns of thousands or even tens of thousands of francs. Optimise your third pillar by transferring your pillar 3a assets to VZ. When it comes to your vested benefits assets, VZ also offers a wide range of account and investment opportunities.

A pillar 3a with VZ is one of the most attractive pension solutions involving securities

Pillar 3a with ETFs: build up assets and save on taxes

At VZ, you invest your pillar 3a assets in the best ETFs and other index funds and thanks to the lower fees, you can generate additional returns of thousands or even tens of thousands of francs over the years. Due to its flexibility, you can tailor your pillar 3a with ETFs in line with your personal risk tolerance and structure it online according to your preferences at any time.

How does saving the pillar 3a with ETFs work?

VZ offers a pillar 3a with a definable equity component of between 15 and 97 percent. The remaining part is invested in fixed-income assets, real estate, commodities and specialities. To implement the investment strategy, we make use of ETFs or other cost-effective index funds in practically all asset classes.

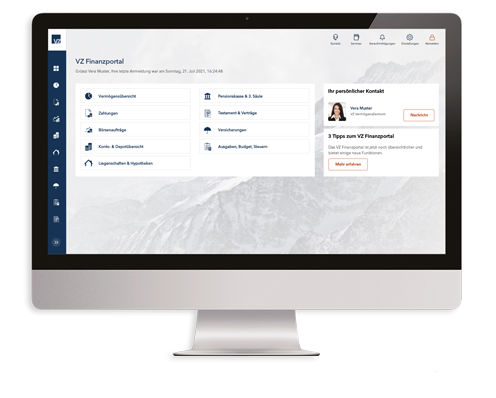

You can log in to the VZ Financial Portal at any time and access your 3a account, where you can quickly and easily restructure your investments. Reduce your equity weighting, for example, when you expect prices to fall and increase it again once the outlook is brighter.

Why ETFs in a pillar 3a solution?

ETFs and other index funds aim to identically replicate an index such as the SMI or Dow Jones. For private investors in particular, they are an attractive asset class whose advantages are fully leveraged in the pillar 3a:

- Low fees: ETF and other index funds are cost-effective because unlike traditional, actively managed funds, they do not require any expensive fund management

- Protection in the event of insolvency: money invested in index funds remains the property of the investors even if the issuer becomes insolvent

- High level of transparency: you can see where your money is invested at all times

- Diversification: ETFs and other index funds invest in various different regions, countries, sectors, themes and asset classes, which lowers risk

Who is a pillar 3a with ETFs suitable for?

It is essential for working people to build up their assets for when they retire. A pillar 3a with ETFs is an intelligent investment solution for people with an eye on fees and who want to make the most of the opportunities offered by private pensions.

What does a pillar 3a with ETFs cost?

Many providers charge fees that sometimes amount to 1.5 percent for pillar 3a securities solutions. At VZ, the management fees amount to just 0.68 percent per year. This covers transaction fees, issuing commissions, redemption fees and securities account fees. Investing new money and rebalancing is free of charge. This makes the pillar 3a at VZ up to 60 percent cheaper than at other providers.

How does a pillar 3a with ETFs differ from other products?

The pillar 3a at VZ differs from other pillar 3a solutions thanks to the tangible benefits it offers:

- Flexible investment strategy: you can choose from six investment strategies with an equity weighting of between 15 and 97 percent

- Up to 60 percent more cost-effective: the management fees amount to 0.68 percent per year, which makes them significantly lower than at other providers

- Independent selection: VZ does not sell its own financial products and does not earn any money from brokerage commissions

- Automatic rebalancing: when prices fluctuate significantly, the composition of the securities account can deviate significantly from the defined investment strategy. If the current weighting deviates too sharply, the asset classes are rebalanced in line with the strategy free of charge at the end of the month. This rebalancing can have a positive impact on returns.

- Holding ETFs beyond retirement: the pillar 3a at VZ allows investors to transfer the ETFs into their private securities account on retirement. This reduces the risk of having to sell the investments at a time when prices are low.

Regularly learn how you can optimise your OASI, pension fund and 3rd pillar:

Pillar 3a with individual stocks: tapping into the return opportunities of equities

Switzerland’s first pillar 3a with individual stocks is highly transparent and offers an ideal level of diversification. With this pension solution from VZ, you can benefit from the return opportunities presented by individual stocks, while building up your assets over the long term.

How does the pillar 3a with individual stocks work?

The pillar 3a with individual stocks invests in the top 20 capitalised Swiss companies. The equal weighting of the individual stocks increases transparency and improves diversification. In the other asset classes, ETFs and other cost-effective index funds are used.

An intelligent rebalancing process ensures that the investment strategy is followed. If an asset class exceeds or falls below the relevant bandwidth, it is returned to the original weighting taking into account the current market environment.

Why individual stocks in a pillar 3a solution?

Equities help reduce the average product costs in your portfolio. Furthermore, portfolios with individual stocks are particularly transparent as investors can see at all times what proportion of their money is invested in which companies.

Who is a pillar 3a with individual stocks suitable for?

A pillar 3a with individual stocks is an attractive pension solution for investors with a medium to aggressive profile.

How high are the fees for a pillar 3a with individual stocks?

VZ charges a flat-rate management fee of 0.68% per year for all its services. This makes Switzerland’s most wide-ranging and flexible pillar 3a extremely cost-effective too.

How does a pillar 3a with individual stocks differ from other products?

The pillar 3a with individual stocks is Switzerland’s first pension solution of this kind. It has a number of concrete advantages over other products:

- Lower fees: investors holding individual stocks lower the average cost of their portfolio.

- Maximum transparency: by using individual stocks, you always know what proportion of your money is invested in which companies.

- High level of diversification: The approach of investing equally in the 20 largest Swiss companies and in the other asset classes, in ETFs and other index funds, ensures broad diversification.

- Independent decision-making: with VZ as a partner, you can be sure that your investments are always selected independently and in line with your interests.

Regularly learn how you can optimise your OASI, pension fund and 3rd pillar:

Vested benefits: investing retirement asset cost-effectively

You can park your pension assets from the second pillar on a vested benefits account. For example, if you become self-employed or take a career break. At VZ Vested Benefits Foundation, you can invest your vested benefit assets cost-effectively and optimised from a tax perspective. You choose the investment strategy that matches your personal risk capacity and level of experience in securities. As VZ does not sell its own financial products and only uses investment instruments that perform well in an objective selection process, we only select investments that are in your interests.

What does a vested benefits foundation do?

Irrespective whether you leave a company due to losing your job, taking a career break, pursuing further education or travelling: You will have to leave your previous pension fund and transfer your accumulated pension assets to a vested benefits account.

A vested benefits account is an account with a vested benefits foundation. The foundation invests your retirement assets and manages them as a pension fund would. The purpose of the vested benefits foundation is to preserve the pension assets accumulated in the area of occupational pension provision.

Once you start a new job you are legally required to transfer your vested benefits to the pension fund to which your new employer is affiliated.

Which investment strategies can I choose?

Together with our VZ experts you derive an individually tailored investment strategy. Your needs are thereby the main focus. The selection of investments range from conservative strategies with no equities to a growth-oriented focus with an equity share of 90 percent.

What are the advantages at VZ?

With the VZ Vested Benefits Foundation, you can invest your assets in a tax-efficient way within the scope permitted by law.

These are the advantages of the VZ Vested Benefits Foundation:

- Cost savings: primarily ETFs and other cost-effective index funds are used.

- Flexibility: investors benefit from a wide range of investment strategies. The investment strategy can be adjusted on a weekly basis.

- Overview: with online access, you can keep an eye on your securities account and adjust your investment strategy at any time. You will receive transparent reporting on a quarterly basis.

Regularly learn how you can optimise your OASI, pension fund and 3rd pillar:

Retirement planning: sound financial cover

How high would your income be if you were no longer able to work as a result of accident or illness? Which insurance benefits would your family receive were you to die? And how much money will you have after you have retired? If you would like answers to these questions, then it’s a good idea to plan your retirement with VZ.

Our retirement experts will check how well covered you would be in the case of accident and illness and whether you require any additional insurance cover. And they will show you how to get the most out of your pension fund and pillar 3a so that you can enjoy your retirement without any concerns over your finances.

Why is it a good idea to review your retirement plans?

In the event of death or disability and upon retirement, the money provided under the statutory minimum insurance schemes is often not enough to maintain your usual standard of living. Pension gaps are especially large for self-employed workers and high-earning employees, such as management staff, as the benefits target is based on normal earners. In addition, self-employed workers are not obligated to be members of a second pillar pension fund.

Who is retirement planning suitable for?

It is particularly advisable to review your retirement situation after receiving a pay rise or changing jobs, when buying a property, starting a family or becoming self-employed – and at least every five years in any case.

What are the advantages of planning your retirement with VZ?

VZ does not sell its own products and does not earn any money from brokerage commissions. This means you can be sure that our experts will always provide you with independent advice in line with your interests. With VZ’s retirement planning service, you will know how to best close any gaps in your retirement plans and which providers offer the best value for money. An independent consultation always pays off: it results in security for the whole family, lower premiums and taxes, in addition to better benefits and higher returns.

Regularly learn how you can optimise your OASI, pension fund and 3rd pillar: