Tips on buying real estate for foreign workers

There are a number of issues that must be taken into account by foreigners wishing to buy real estate in Switzerland. Buying property is always a major investment, which also involves a certain amount of risk. If buyers do not understand the local market and potential pitfalls, they could get into trouble and face heavy losses.

Is authorisation required to buy real estate?

There are no restrictions for EU/EFTA nationals resident in Switzerland who wish to buy real estate. Citizens of other countries with at least a ‘B’ category residence permit can buy property in their Swiss place of residence if they themselves will permanently live in it.

What is the maximum possible purchase price?

As a rule, Swiss banks will help finance owner-occupied homes up to a maximum of 80 percent of the purchase price. A mortgage of this size is considered to be financially affordable if the interest, amortisation and maintenance costs do not exceed one third of buyers’ regular gross income. To calculate whether a property is affordable, banks do not use the current low interest rates, but instead base their calculations on a long-term average interest rate of 4.5 to 5 percent. If you have already been working in Switzerland for a number of years, you will already have assets in your pension fund and, potentially, have contributed to your pillar 3a, some of which you can put towards the deposit needed to buy your own home.

If the purchase price justified?

Property prices in Switzerland have risen sharply in recent years. If you don’t want to pay too much, you should get an independent market value assessment? This will show whether the purchase price is fair and appropriate. Usually a so-called "hedonic valuation" will be enough, which only costs a few hundred francs. A more expensive valuation, where a real estate expert visits the property in person, is especially worth it when the property is in need of signification renovation or is a particularly unusual property.

Which fees and taxes are incurred when buying a property?

When buying a property, notary and land register costs are incurred, while in many cantons, property transfer taxes are also levied. Depending on the canton, these taxes and fees can total up to 5 percent of the purchase price. In many cantons, it is standard practice for the buyer and the seller to split these costs 50:50. Any property transfer taxes are borne entirely by the selling party. Buyers should make sure, however, that the seller deposits the property transfer tax amount in a blocked account or guarantees it in another way. In most cantons, the tax authorities are able to recover this tax from the new owner if the seller does not pay it.

What do I need to pay attention to with regards to the contract of sale?

The selling party is usually a real estate profession, who will formulate the sales / works contract solely in their favour. You should be especially careful when buying property that has not yet been built. Disadvantageous guarantee clauses, for example, can cause a great deal of trouble and result in considerable losses. If your advance payment is mis-used by the general contractor, there is a risk that you could have to pay for the same service twice.

How do I find a cheap mortgage?

Banks want to earn as much money from their customers as possible. This is a classic conflict of interests, as what is good for lenders is often a bad deal for borrowers. That’s why it is not surprising that banks primarily recommend medium- to long-term fixed mortgages. It is with these mortgages, however, that homeowners have by far paid the most over the last 30 years (see table). If you choose the right mortgage model or right mix of various models and terms, you could save tens of thousands of francs over the years.

Where can I get the best advice?

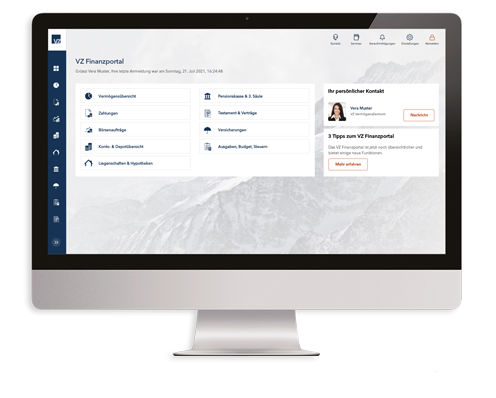

The independent real estate and mortgage experts at VZ provide advice and support on all issues relating to buying real estate. Arrange an appointment now for a non-binding initial consultation at your local VZ branch.