Financial investments: what you need to know

Anyone wanting to successfully invest money should adopt a structured approach and first of all, decide on the right investment strategy. When implementing this strategy, investors in Switzerland should primarily focus on low fees, avoid banks’ own investment products and not take any unnecessary risks with their investments.

Recommend post

Finding the right investment strategy

Your investment strategy defines what proportion of your portfolio is to be invested in certain asset classes, such as equities and bonds. Many private investors are not aware that around 70% of the performance of their securities account depends on the investment strategy. This makes it a decisive factor in the success or failure of their investments.

When determining an investment strategy, an investor’s risk capacity and risk tolerance must be taken into account. An investor’s risk capacity is a measure of the financial losses they can accept. The degree to which an investor can cope emotionally with temporary losses on their investments depends on their risk tolerance.

As personal circumstances can change, it is recommended to periodically review your investment strategy. When retiring, for example, it is a good idea to alter your investment strategy: after you have stopped working, the focus shifts from building up assets to a controlled depletion of these assets.

Avoiding unnecessary risks

What is a sensible target when it comes to investing money? For most investors, it would be to achieve returns in line with the market and in accordance with their risk profile. This means gaining and losing a similar amount over the long term as the market as a whole.

While this may sound unspectacular – especially when fund managers and investment advisors promise that their products will “significantly outperform” the market – these promises are usually based on wishful thinking rather than reality. Numerous studies have shown that almost nobody is able to consistently outperform the market. As such, investors are best advised to set realistic long-term investment goals.

Avoiding banks’ own investment products

For bank advisors, it is usually in their best interest to recommend investment products from their own bank, not least because it is far more lucrative for banks to sell their own products rather than any other investments.

A VZ study shows that banks’ own products tend to offer significantly lower returns. These are often active investment funds. Active investment fund managers attempt to outperform the market by following complex processes. This not only results in higher costs, but experience shows that only very few funds are actually able to outperform their benchmark. Banks’ own funds do not produce miraculous returns – quite the opposite! Most of these funds perform averagely at best, with some lagging the best in their category by some distance.

Sustainably investing money

It is becoming increasingly important for investors that their investments also take aspects reagarding the environment, society and governance into account.

ESG ratings can be used to filter out companies that perform particularly well in terms of sustainability criteria. However, each ratings agency has a different understanding of the term sustainability, meaning that a company can do well with one agency, but get a poor mark from another. As such, it makes sense to combine numerous ratings.

Focusing on low fees

Many investors neglect the costs: they often have no idea what fees their bank charges them for buying, selling or safekeeping securities. This means that these costs often eat a long way into their returns. An independent securities portfolio check will show where potential savings on fees can be made.

The differences in costs between the various banks are huge. By changing to a more cost-effective bank, investors can save up to 70 percent on fees. While moving securities from one bank to another can cost a lot in transaction fees, the price differences for securities account and transaction fees are so big that the costs of changing to a more cost-effective banks can often be recouped in the first year.

As an example, an investor with a securities account worth CHF 500,000 would pay an average of almost CHF 8,800 at the largest Swiss banks if they perform 40 buy or sell transactions for CHF 20,000 each. At VZ, these fees would only amount to CHF 1,750 if the investor chose the flat-fee model, which is still more cost-effective in their situation than the ticket fee model. They could therefore potentially save CHF 7,000 a year.

Not hoarding too much money in the accounts

A recent VZ survey of around 6500 households shows: On average, families hold more than CHF 270,000 in liquidity in their accounts. In most cases, this amount is far too high. If this money simply sits in an account, it loses in value every year. Since interests are low, the compound interest effect does not apply. At the same time, savings are depreciated by taxes and inflation.

What does make sense is to hold half of an annual salary in your private account. This amount usually suffices to cover the living expenses. It is considered appropriate to invest another half to a full year's salary in a savings account. However, this money should receive interests in line with the market, which is not the case at many banks today. It is therefore recommended that you switch to a bank offering you fair interests.

Smart, cost-effective investing with exchange-traded funds

Exchange-traded funds (ETFs) are passive funds, which in contrast to traditional investment funds, are not actively managed. They do not try to outperform a benchmark by buying and selling securities based on opinions and judgement calls. Instead, ETFs aim to replicate the performance of an index, for example the SMI, Dow Jones or DAX, as closely as possible. If the index rises or falls, the price of the ETF also rises or falls. As there is no active stock selection, costs for ETFs are far lower than for actively managed funds.

Investment advice with no conflicts of interest

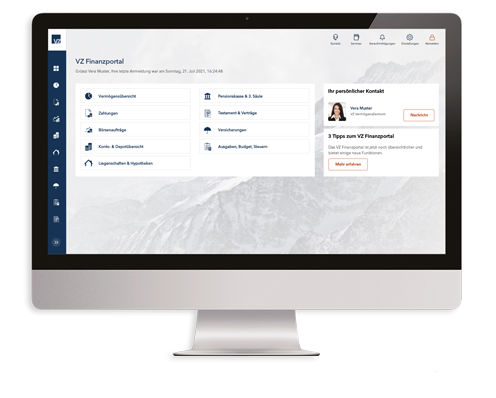

The investment specialists at VZ judge financial investments impartially because they do not earn anything from recommending specific products. We give you just as much support as you need – no matter whether you wish to invest your money yourself and receive regular investment proposals from our experts, or choose to have your assets managed by a professional as part of a portfolio management mandate.

An independent securities portfolio check at VZ will identify any weaknesses in your financial investments and any potential conflicts of interest for your bank. You will find out how well your securities account has performed compared to the market and compared to other investors, and also whether your securities account is exposed to an excessive risk of losses or whether hidden fees are eating into your returns.